Deal Advice

Before we get started here, it’s important to remember that “No deal is better than a bad deal”. To be successful when doing deals, you have to be a master at the evaluation process. Sadly we have seen many investors buy properties that were NOT deals and they didn’t find out until they were in the middle of it or just about to put it on the market. That’s heartbreaking.

Warren Buffet’s investing Rules hold in every case:

Rule #1: Never lose money.

Rule #2: Never forget Rule #1. The way we make sure we don’t lose money is by completing thorough and detailed due diligence. This isn’t a game. This is real money. Act accordingly.

We can assist you through the process of turning a suspect into a prospect. The best way to do that is spend some time with us by attending our next training – Check out our EVENTS page to get plugged in!

We’d much rather show you the right way to do something than try to fix something that is broken. Plus what you learn on deal #1, you may not experience again until deal #121. Real estate investing is a mile wide, not a mile deep – meaning that there are so many gotcha’s and special cases in investing and real estate that it takes time to learn it all and you could make a lot of mistakes along the way (read: you could lose a lot of money and/ or time and/or faith).

We bring this up because we meet new investors all the time that are so anxious to get their first deal that they are blinded to examining the facts, looking at a best/worst/most-likely case scenarios and ultimately skip the basics of sound due diligence. Don’t be in a rush to do the deal, be in a rush to do the do diligence. That being said, it’s always okay to 1) get it under contract, 2) do the due diligence and 3) renegotiate or terminate if the deal isn’t what you thought it was.

My left brainers (Analytical types who never saw a spreadsheet they didn’t like) hate this because they don’t like taking action without all the facts and they don’t always feel “in integrity” by knowing they may have to renegotiate later. To help get you past this feeling, I’ll tell you that I’ve seen a lot of left brain analytical people working on their due diligence for weeks while the right brain, action takers get it under contract in the first meeting (knowing there’s still work and due diligence left to be done and knowing there’s a probable renegotiation in their future). Another reason to take the “Ready, Fire, Aim” approach is that many of the homeowners we work with come to us at the very last minute and if we wait on getting it under contract and getting title opened, we lose precious time and that might result in you not getting the deal, but even worse, the homeowner losing their dignity and equity in a foreclosure. So from that standpoint, it’s your imperative to take action. My right brainers take action intuitively but in many cases take the wrong action. “Knowledge on Ice vs. Ignorance on Fire” At our EVENTS we give left brainers the confidence to take action quickly through our step-bystep approach AND we give the right brainers the skills and intel they need to do things correctly

Real estate investing, like many things, is simple, but it’s not easy. Some people suggest, it’s just sticks and bricks and math. That’s true. But there’s also plenty of nuance and tribal knowledge necessary to invest profitably. That’s where our team comes in. As part of Texas REIAS we’ve been helping people 1) make money 2) save money and probably most importantly, 3) not lose money by sharing our experiences.

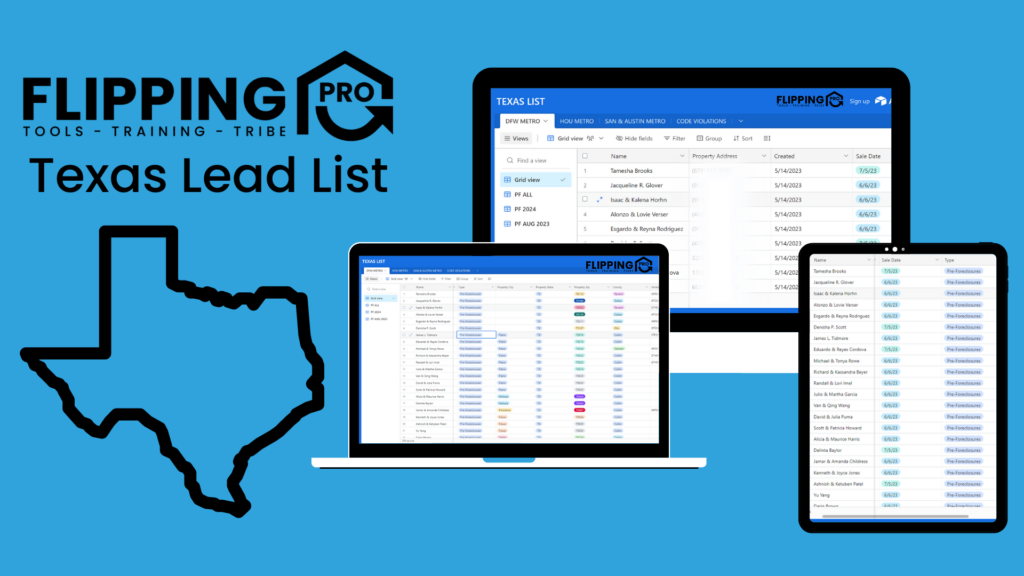

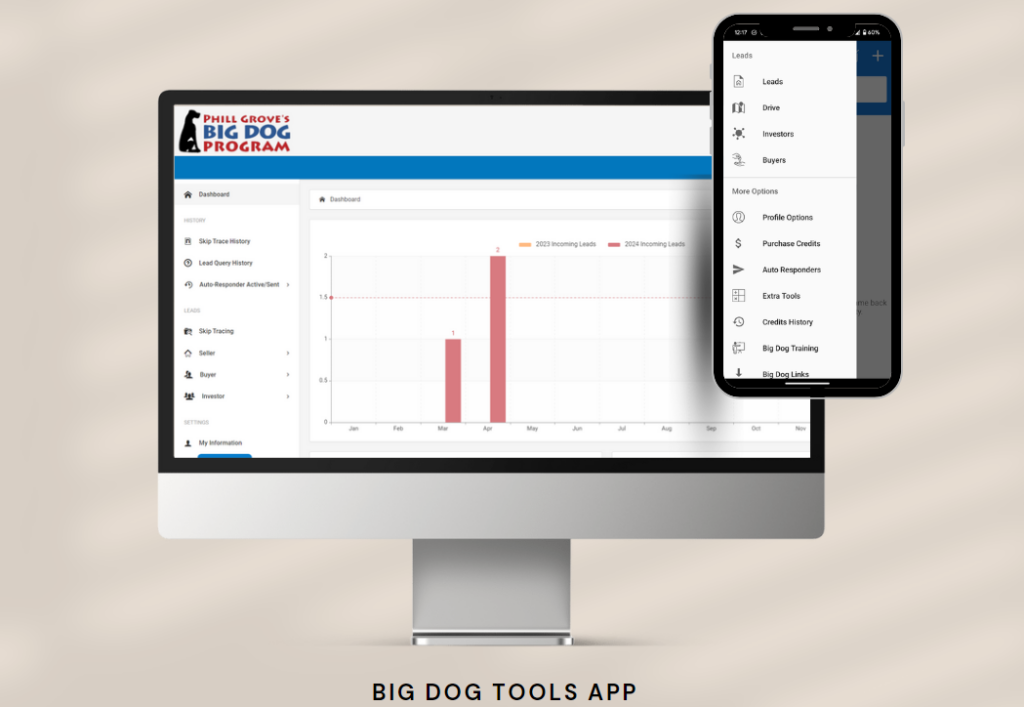

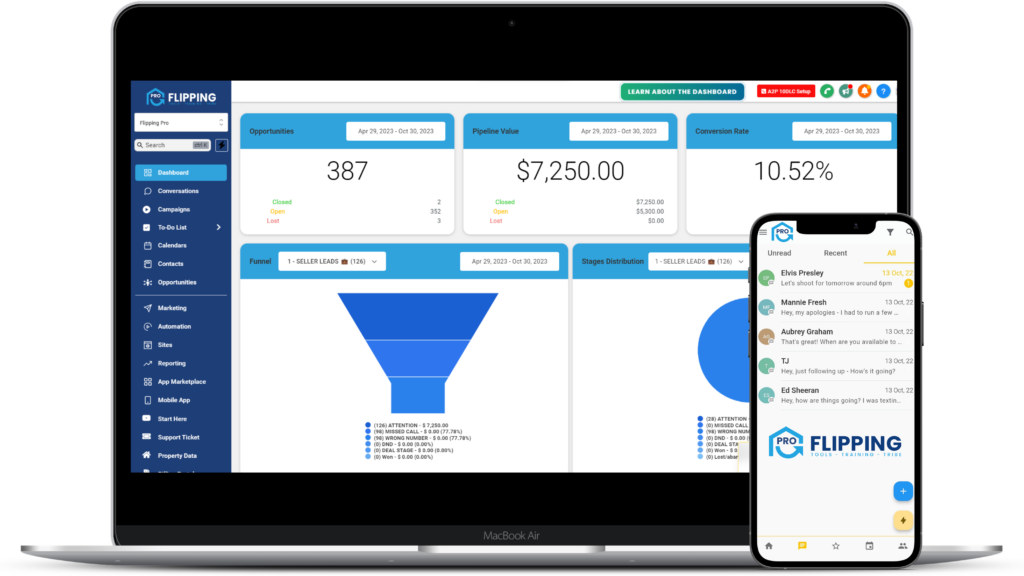

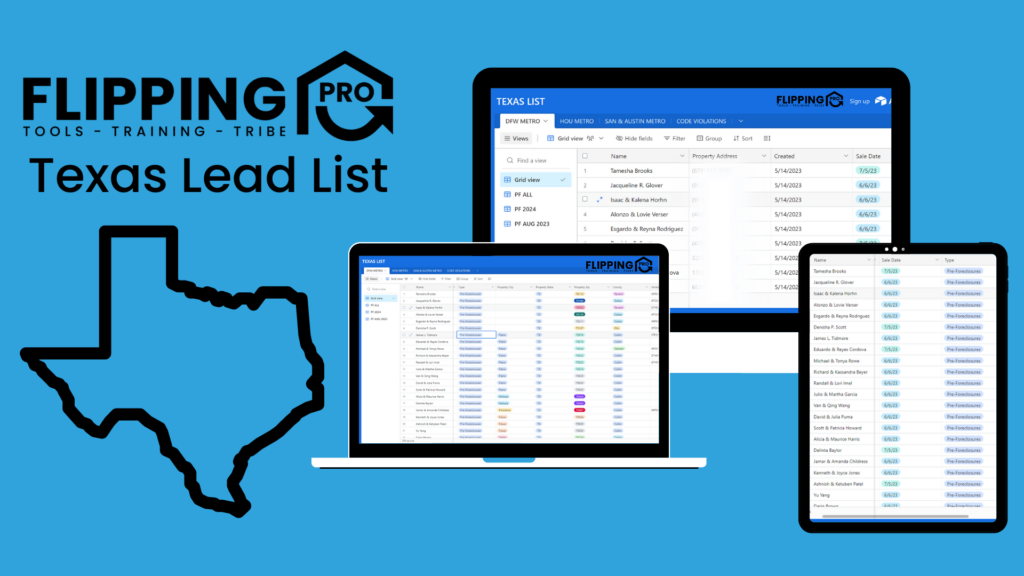

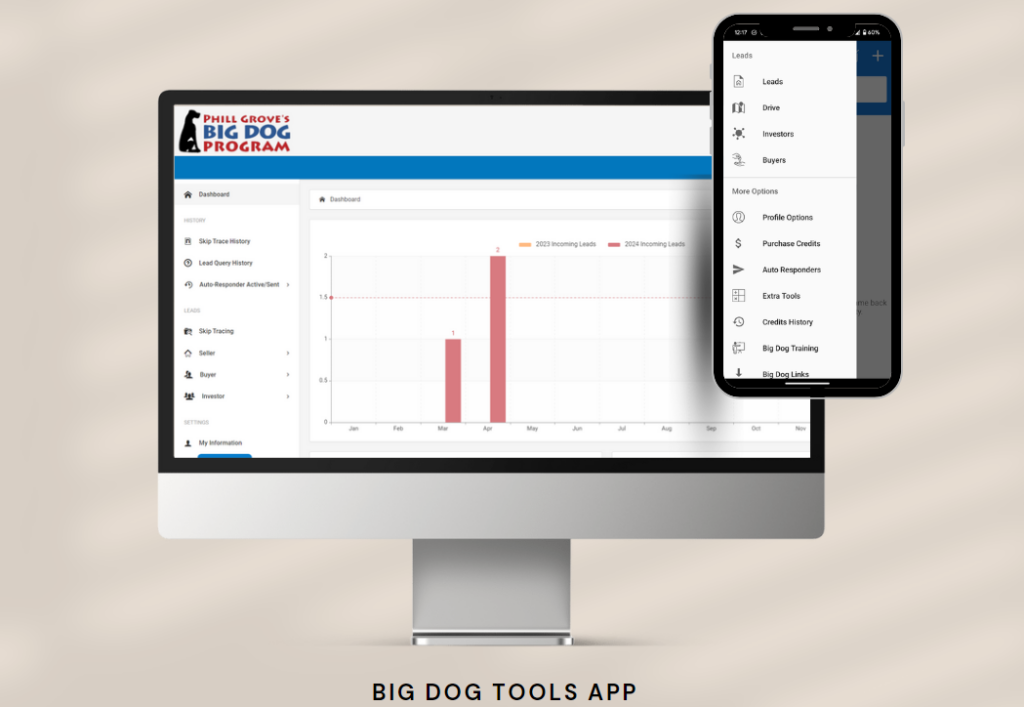

Tools – To be a successful real estate investor you have to have access to the right tools and the tools are always changing. We stay cutting edge in our business practices and tools so we can help owners, help buyers and win in every market – no matter what challenges the market puts in our path. Our objective is to find and use tools that put us in front of sellers first, give

us the best opportunity to find the owner and contact them in a technologically sophisticated manner that takes the effort out of investing. Plus we have tools to help us analyze deals quickly and come up with creative offers that work based on each unique situation. The game changing tools are always improving and so is Texas REIAs.

Training – We are huge believers in the power of training and continuous education. We have successfully invested in every part of the market cycle and we are “full cycle” investors (investing through both good times and bad). To be able to survive and thrive regardless of whether the market was up or down, we had to adopt an attitude of “Adapt, Mutate, Migrate or Die”

- We have continually and consistently adapted and mutated in our business by having a “strategy to make money every time the phone rings” - what that means for us is we can help people regardless of their equity position AND make money while doing it.

- We have honed our strategies and adjust them based on where we are and where we are going in the market cycle. Like Wayne Gretzky says “Skate to where the puck is going, not where it has been”.

- We have honed our negotiating skills using the training of Chris Voss (Never Split the Difference), Chase Hughes (The Six-Minute X-ray), Alex Hormozi ($100M Offers), William Dry (Getting Past No), Roger Fisher (Getting to Yes), Phil M Jones (Exactly What to Say) and others and adapted it for the real estate situations we encounter daily - developing scripts that overcome objections and asking questions that uncover the Black Swan.

- We have developed ways to purchase property subject-to the existing mortgage to take advantage of low interest rates and turn low profit deals into high profit deals, while raising sellers credit scores and speeding up the time to close while keeping the seller protected.

In real estate and in life, we believe that if you are not growing and learning then you are dying. We love what we do and we are students of the market and are committed to that philosophy. As former Engineers, Computer Science geeks and MBA’s, “The art of the deal is our passion” and real estate allows us to live it out, in a profitable and sustainable way, every day.

Tribe – When we first started investing we attended the local REIA meeting. That’s where we got our first deal, our first lender and the tribal knowledge we needed to take it to the finish line and profit.

Without this community, we might still be working a 9-5 job making someone else rich. At this point in our careers, success, income and wealth, we don’t need to help others as part of the REIA, but we feel the need to pay it back by continuing to pay it forward to our members.

We know we can’t individually help every owner on our own, but we know we can give our members the tools and knowledge that will extend our reach beyond what we can do on our own. That’s powerful. And it’s our life work in action every day.

The goal of our tribe is to make sure people can sell their houses with dignity and equity and our members can figure out win-win deals by using our 12 creative investing strategies. When we got in this business we saw the income and wealth building power real estate could bring. Then we saw the impact on the communities we served. Then we started teaching people and we saw the impact on other investor’s income and wealth and then on the communities they served. That’s purposeful. And it’s the legacy we leave as part of Texas REIAs.

Walk in the footsteps of someone who has gone where you are going!

If you are interested in commercial investing, we recommend you start at either the local REIA meeting (just to get to know us) and then sign up for our upcoming Big Profits Live Class – our high level commercial training. You can register for these on the Events page.

After that we have additional commercial training that is by invitation only where we explore multiple commercial asset classes – Apartment Buildings, Self-Storage, Residential Assisted Living, Mobile Home and RV Parks, Land Development, Oil and Gas and Mineral investing and more.

Club Disclaimer: Your personal level of success in attaining the results from using our information and strategies discussed at our events totally depends upon your own individual circumstances, the effort you devote to your own financial success, the ideas and techniques used, your finances, the various strategies that your financial, legal, and other advisors may have suggested that you implement, your knowledge, and various other skills. Since these factors differ among each individual, we cannot guarantee your success or income level, nor are we responsible for any of your actions.

Code of Conduct Policy: While Networking with others at the Club is encouraged, we strongly recommend you perform your due diligence prior to entering into any real estate agreement. For more information, please refer to our Club Members Code of Conduct Policy